Oops! Accident Happens While Travelling — Your Quick Survival Guide

Picture this: you’re strolling through a bustling market in an exotic city when—boom!—you’ve been caught in an accident that costs you dearly, both in pain and in money. You’re already on your toes; the next thing you want is to know how to keep that fateful event from turning into a long‑term bill‑busting nightmare.

Step 1: Snap, Save, and Store Every Piece of Evidence

- Take photos instantly. Even a tiny fender‑bender needs a snapshot that shows the position of everyone, all skid marks, and any damages.

- Keep receipts and receipts. Save copies of the incident report, your itinerary, receipts for every noodle bowl you bought, and any medical bill—yes, that gelato order at the hospital but truly!

- Ask for a police report. If the accident is serious and you’re in a hospital, request the official report. It’s your golden ticket in case insurance is slow or any legal drama looms.

- Inform your insurer on the spot. Call your travel or health insurance right away. Follow their instructions—this keeps the claim moving faster than a fast‑food drive‑through.

Step 2: Empty the ‘Accident‑Cost’ Wallet ASAP

It’s tempting to put a huge medical bill on hold, hoping the insurance will eventually pay up. But let’s be real, that’s a recipe for a debt storm.

- Pay the stack of bills now. Use up your credit card or any other payment method before the interest starts piling up.

- Do not settle for the minimal payment. If you’re stuck with a hefty hotel bill, medical invoice, or transport fare, keeping the balance open can turn into a seven‑year debt saga.

- Speed up the claim. In many countries, especially those with hike‑high medical fees, you’re better off clearing the bag yourself and then filing your claim. 50% of the claim might cover the rest—don’t let that money slip by.

Bottom Line

Accidents abroad are scary enough, but adding unclaimed liabilities to the mix can keep you stressed long after the trip ends. Grab every piece of evidence, hit those bills while the bills are still small, and give your insurer the prompt they need to close the loop quickly. Then you can look forward to your next adventure—and this time, stay accident‑free (or at least accident‑ready).

When the Adventure Turns Into a Mishap: Tailoring Your Baggage to Avoid Medical Bills

A Look Back at AXA’s 2013 Treasure Hunt in Medical Costs

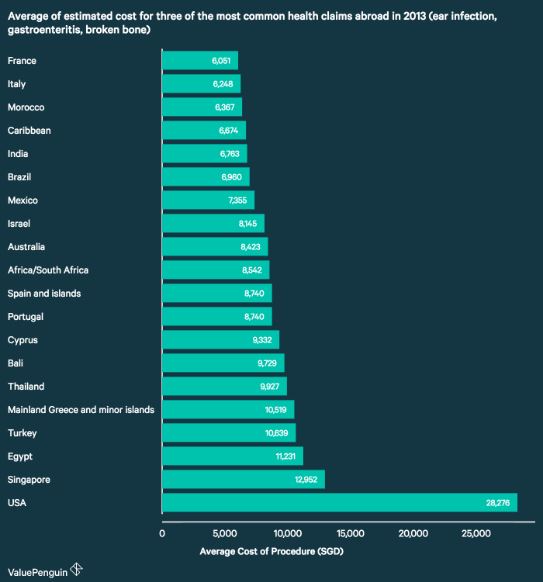

AXA’s 2013 study dove deep into the price tags of global healthcare, spotlighting three classic travel casualties: ear infections, gastroenteritis (aka stomach drama on the road), and broken bones from a slip or a fall.

Ready to Dodge the Bill Surge After a Hiccup Abroad?

- Talk it out with the hospital. Hospitals love up‑front cash over monthly installments—so a friendly negotiation can shave a few bucks off your invoice.

- Ask for a 0% interest plan. If cash is tight, a zero‑interest repayment schedule lets you chip in what you can each month—without the dreaded compounding that turns a few hundred into a fortune.

- Keep a cushion for the unexpected. Having an emergency reserve (cash or a savings account) is your safety net for any last‑minute health fuss.

Financial Finessing: Books, Airlines, and Lodgings—All From One Roof

When you map out your next adventure, think “What if?”. A single-purpose trip budget can leave you exposed if you face an overseas mishap. Building a dedicated fund for healthcare, litigation, and repatriation shields you from the “ha‑ha” moment of realizing you’ve run out of money in the middle of a Thai street‑food spree.

In short: plan ahead, negotiate smart, and keep a financial safety cushion. Because traveling is all about waving your passport, not hustling through medical bills.

Getting Covered While You Explore: Why Travel Insurance Is Your New Best Friend

Ever been stuck on a beach with an injury, a broken flight, or a rogue rental car that goes beyond its warranty? Saving yourself in such a scenario can cost a pretty penny — a few cents for you, thousands for your hospital bill. That’s where travel insurance steps in: a cheap little expense that can turn into a lifesaver.

What It Gives You (and Why You Should Pay a Couple of Dollars for It)

- Medical Coverage – If you cough up a sore throat in Peru or get a nasty sprain in Iceland, the insurer’s got your back.

- Accident Protection – Whether you plate your car on an icy road or slip and tumble on a cliffside, damages won’t leave you out‑of‑pocket.

- Trip Curtailment – Weather catastrophes or personal emergencies can cut your vacation short; the policy helps cover your refunds.

- Repatriation – If you’re stranded far from home, it can cover the cost of getting you back safely.

- All‑Year “One‑Stop” Coverage – Buy an annual plan and you’re insured every single trip you take in twelve months.

Stitch It Up With Your Itinerary (No One‑Size Fits All)

Want the right coverage? Tailor it to what you’re actually doing.

- Ride? Make sure your policy covers rental cars. If driving is part of the adventure, you’ll want protection against accidents or breakdowns.

- Sports Enthusiast? Because you love extreme hobbies—kayaking, zip‑lining, rock climbing—pick an insurer that covers injuries or equipment damage.

- Itinerary Specific? If your trip is centered around certain activities, look for specialty coverage for those exact adventures.

That’s the scoop: a small fee that can fork you huge returns when mishaps arise. Pick wisely, plan for your actual trip, and you’ll have peace of mind so long as you’re globe‑trotting or just planning a getaway. Happy travels!