EarthOne: A Fresh Buzz for Planet‑Friendly News

AsiaOne has rolled out EarthOne, a brand‑new section that dives deep into the planet’s health. It’s all about loving Earth, getting science straight, and proving that environmental stories matter. Check out more articles in the same vein right there.

Under the Spotlight: The Glacial Reality of COP26

When the UN’s big climate conference kicked off in Glasgow on Sunday (October 31), one head‑lining theme quickly drowned out a chorus of promises from governments and corporations worldwide: Money.

What COP26 Aims to Deliver

The summit’s main job is to nail the rules that help enforce the 2015 Paris Agreement, which tries to keep global warming under 1.5 °C above pre‑industrial levels. It’s also about nudging countries to set bolder targets to hit those lofty goals.

The Financial Backbone of Climate Success

- Richer nations—those who’ve contributed the bulk of greenhouse gases—agreed to funnel funds to poorer countries. These funds should help them cut emissions and adapt to the rising seas, storm damage, and droughts that bad weather brings.

- So far, the promised cash hasn’t materialized.

Key Numbers You Should Know

- In 2009, the richer states pledged to hand out $100 billion (S$134.7 billion) a year by 2020.

- Instead, that figure will only hit the shelves in 2023.

Voices from the Front Lines

“Their credibility is now shot,” declared Saleemul Huq, an adviser to the Climate Vulnerable Forum representing 48 countries. He warned that the missed financial promise could “sour everything else” at the Glasgow talks. “They’re basically dropping the planet’s most vulnerable people in a hurry after promising a helping hand,” he added.

The Alliance of Small Island States—small on paper but mighty in influence—highlighted the damage to trust. “The impact this has had on trust cannot be underestimated,” the group said.

Symbolic target

On the Road to the $100 Billion Milestone: Climate Funding Gets a Reality Check

When the heavy‑handed wind of the COP26 summit blows, it’s not just the weather that’s a problem for many countries—turning negotiations into a high‑stakes tug‑of‑war that can’t seem to find its footing. The latest conversation was a clear sign that countries will still wrestle over issues that have stalled every climate summit before.

Why the $100 Billion Target Is Just the Tip of the Iceberg

While the pledge of one hundred billion dollars feels like a friendly gesture, it’s shockingly inadequate for the fragile nations that need funds to simply keep the planet from turning into a giant, noisy roulette wheel.

- UN says “We’ll need up to $300 billion a year by 2030 just to keep our crops from dying and our cities from sinking.”

- And that’s before we even get to the cost of major weather disasters. Hurricane Maria hit the Caribbean in 2017, racking up a whopping $69.4 billion in losses.

The Three Pillars of Friction in Glasgow

Frans Timmermans, EU climate chief, put his best foot forward with a triple‑pronged playbook: hit the $100 billion finish line, nail the Paris rulebook, and push for nailing emissions targets that make a dent in the global carbon curve.

“I think we still have a shot at getting to $100 billion,” Timmermans told Reuters, “It would be very important for Glasgow to do that, also as a sign of trust and confidence to the developing world.”

Big‑Foot Steps: Italy, US, And the Rest of the World Walk In

- Italy decided to triple its climate finance contribution, aiming for $1.4 billion per year over the next five years.

- America, by September, promised a boost from $5.7 billion to $11.4 billion per year by 2024 — a figure that analysts say barely scratches the surface of the country’s fair share.

Who’s Still Feeling the Chill?

In the wake of COVID‑19, the poorest nations are getting more frustrated over the perceived slowness of climate funding. The pandemic check‑box of $14.6 trillion mobilized by big economies is a dazzling beacon, but it’s a mere fraction compared with what’s needed for a future which doesn’t look like a Netflix disaster playlist.

“One thing that the pandemic showed is that if the priority is big enough, the spending can follow,” said Lorena Gonzalez, senior associate for climate finance at the World Resources Institute.

A Sprint of Mini‑Deals to Rebuild Trust

During the two‑week summit, several quick‑fire agreements are expected to surface as the conference attempts a Swift Justice act of unsigned mind‑maps. Here’s what’s on the table:

- The EU, United States, Britain, Germany, and France set up a joint project to help South Africa speed up coal‑fuelled power phase‑out while investing in renewables.

- Expectations hint that development banks and private sector players will drop their own promises.

Yes, the pow‑pow over coal is real, and yes, the world will almost certainly need a lot more than a few hundred million local CFOs. But with a little humor, a touch of emotional honesty, and a few bold headlines, the conversation can shift from bureaucratic chat to true, action‑oriented chitchat. Let’s keep stride, not just our economy, on a path that protects the earth and preserves the future.

What’s the Scoop on Cloud‑8 Climate Cash?

Ever wondered how much money is actually rolling into climate action? The World Resources Institute (WRI) just pulled back the curtain on the numbers that really count.

Bullet‑Points Guide to the Financial Flow

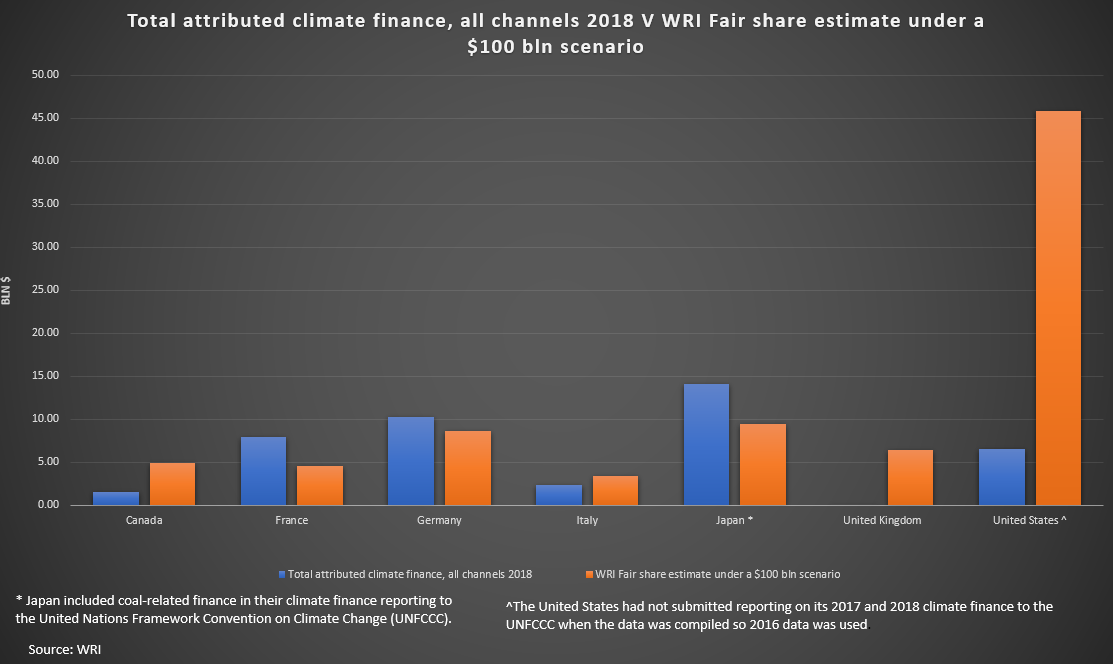

- 2018 Total Climate Finance: Across every channel—government budgets, corporate grants, and private investors—all the money tossed into climate projects added up to roughly $60 billion.

- WRI’s “Fair Share” Scenario: If we imagine every big player injecting exactly $100 billion (the “fair share” target), WRI modelled how that wealth should be split based on GDP, emissions, and vulnerability.

- What the Model Says: Some countries would get more than their fair slice—think financially‑rich regions with high emissions—while others would trigger the “low‑share” flag, meaning they’re not meeting their equitable obligation.

- Alert for the Global South: Under the 100 billion plan, many low‑income nations would see a dramatic jump in financing, but the reality is still far from that ideal.

Why Does This Matter? The “Climate Cash” Insider View

Short answer: because the money we’re pouring into green tech, resilient infrastructure, and community‑level solutions shapes how fast the world can move away from its carbon baggage.

The WRI analysis is a crucial reality check—a reminder that we’re not just talking numbers; we’re actually troubleshooting a budget that has to keep the planet alive.

What’s Next? The Action Plan

1) Boost transparency—make it easier to see where each dollar goes.

2) Use the “fair share” metric to pin down where deficits lie.

3) Engage stakeholders so everyone knows that it’s not just about the money but also the fairness of distribution.

In plain English: The climate finance transfer may look good on paper, but let’s keep an eye on the champs and the laggards. Happy crunching!

Rebuild trust

Money at the Forefront of COP26 Negotiations

While the world listens to the future of our planet, the nitty‑gritty of the Paris Agreement is all about finance. 2026’s demand for a post‑2025 climate money plan is taking center stage, and backers are pushing for tighter safeguards. No more of the “together we’ll do it” vibes of before – the poorer camps want a concrete promise that the cash actually reaches them.

Carbon Offsets: A Sticky Point Yet Again

Another sticky issue? Setting up a carbon offsets market. Back in 2019, this ruckus basically stalled the whole UN climate conference. Now the stage is set to either forge ahead or let the debate simmer again.

Developing Nations Want a Fair Slice

- They’re aiming to earmark a proportion of the proceeds for real‑world adaptation projects – think storm shelters and sea‑rise defenses.

- Richer countries, however, are often against this.

“Those markets need to put one per cent, two per cent – that’s practically nothing – into adaptation. But this is a no‑go for the same countries who are preaching adaptation finance,” said Mohamed Nasr, the climate‑finance negotiator for the African group, to Reuters.

Private Capital: A Rough Hike for Adaptation Projects

Getting private investors on board for adaptation is tough, mainly because many of these projects don’t pay back a tidy profit. When governments contribute, the funnel tends to favor other uses.

In 2019, donors pumped in a whopping $79.6 billion in climate finance, but only one‑quarter of that went into adaptation, according to the OECD.

Bottom Line

All eyes are on how COP26 negotiators will balance the hard math of money with the sweet demand for real, tangible solutions that protect communities from climate change. Will the richer nations step up, or will the plan stall again? Only time – and the bargaining tables – will tell.