Got the HDB Grant Jargon? Let’s Crack It Open!

Buying a new flat in Singapore can feel like a treasure hunt. With HDB BTO (Build‑To‑Order), Sale‑of‑Balance‑Flats (SBF), or a resale property, you’re dealing with a maze of grants that all sound alike but actually help different people in different ways.

Why Resale Buyers Get the Big Bucks

Think of it this way: BTO and SBF are already discounted by HDB, so the government doesn’t feel the need to double‑down with extra subsidies. Resale homes? They’re a little pricier, so the state chimes in a bit more to make them affordable.

What Determines Your Grant Punch‑line?

- Household income – The lower you earn, the more you qualify.

- Home type – BTO, SBF, or resale.

- First‑time buyer status – First‑time? You may snag a larger grant.

- Co‑buyer details – Some grants ask if you’re buying solo or with a partner.

Quick‑Check Cheat Sheet

- New buyers – Usually get the Goods and Services Tax (GST) exemption and the Home Ownership Incentive (HOI).

- Resale buyers – May qualify for the General Grant, Additional Grant, and the Family Grant if they’re buying as a couple.

- BTO & SBF buyers – Can still claim the Purchase Loan Subsidy but not the larger resale grants.

Budgeting Tips Before You Sign

Plan for:

- Purchase price (plus 2% GST if it’s a resale).

- Stamp duty (5.5% of the purchase price).

- Mortgage application fees.

- Home upgrade costs (bad Sudoku, better style).

Arranging a pre‑approval from your bank can also help you stay within your pocket and avoid last‑minute surprises.

Wrapping It Up

Don’t let the grant confusion keep you from your dream home. Check in with the HDB website or a financial advisor to see what you qualify for, and fly over with a clear budget. HDB is all about making your living easier, so let the grants do the heavy lifting while you focus on choosing a nice set of paint colors. Happy house hunting!

Could you share a bit more about the article you’d like rewritten? A brief summary or key points would help me prepare a fresh, engaging version for you.

Could you share a bit more about the article you’d like rewritten? A brief summary or key points would help me prepare a fresh, engaging version for you.

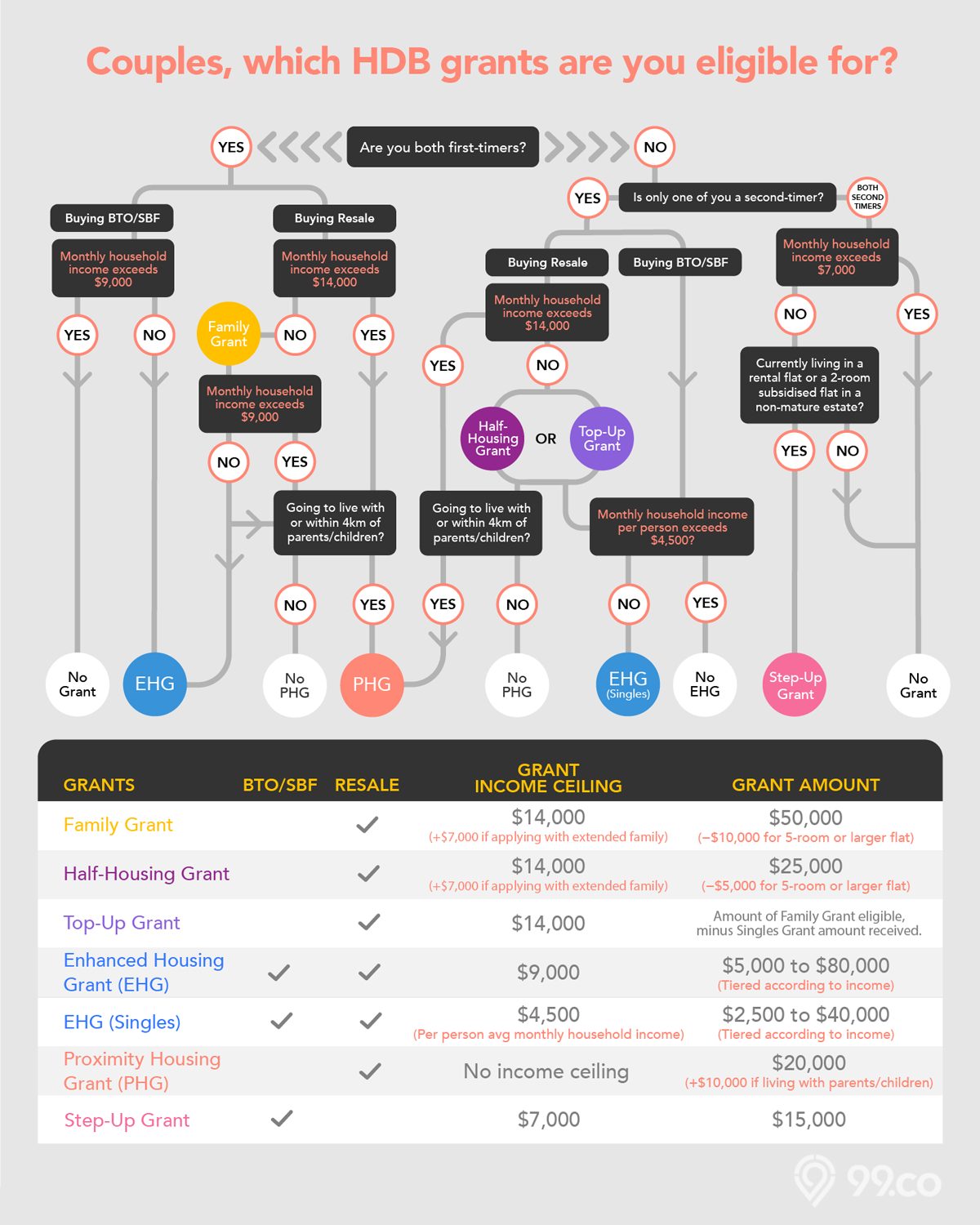

HDB grants for couples applying for BTO/SBF/Open Booking flats

Housing Grants 101 for BTO, SBF & Open Booking Flats

Let’s keep it short and sweet: If you’re eyeing a BTO, SBF, or Open Booking flat, there are only two grant options you can grab:

- Enhanced CPF Housing Grant (EHG) – your golden ticket for first‑time buyers.

- Step‑Up CPF Housing Grant – the upgrade pass for those moving from a two‑room flat or a public rental unit.

Back in September 2019, the EHG took over the spot of the old Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG), so you don’t have to worry about those older names.

Who’s in the Running?

First‑timers: EHG is your go‑to.

Second‑timers upgrading from a subsidised two‑room or rental flat: Step‑Up Grant is your buddy.

The Low‑Income Bonus

Most folks applying for a new flat will probably be chasing the EHG. This grant is income‑tiered, meaning the less you earn, the bigger the grant you’ll get. So lower‑income families get a bit more help — because who wouldn’t want a bigger slice of the pie?

If both applicants are first-timers

CPF Housing Grant Gets a Power‑Up

Great news for house‑hunters! The Enhanced CPF Housing Grant (EHG) has just been turbo‑charged, offering up to $80,000 to help you zero in on that dream flat.

Who Can Grab the Bonus?

- Did your household earn, on average, $9,000 or less per month over the last 12 months?

- Check the timing—make sure the calculation is done right before you submit your flat application.

So, if you’re aiming for the top tier of flats and your income fits the bill, get ready to see that extra boost in your budget!

Income criteria for EHG:

How to Nail the EHG for Your Flat

- Keep the Clock Running: At least one of the applicants should have been on the job track for an uninterrupted 12 months before you toss in the flat application.

- Work, Work, Wave! That same person must still be clocking in at the moment you submit the application.

If one applicant is a first-timer, and the other a second-timer

CPF Housing Grant Scoop: What Singles Need to Know

Look, finding a decent flat in Singapore can feel like a game of Whack‑a‑Block. The government’s Enhanced CPF Housing Grant (EHG) is here to help, but it’s got a few twists that can trip you up if you’re flying solo. Let’s break it all down, so you can keep your landlord worries at bay.

Eligibility Made Simple

- Average Household Income Check – Grab the average monthly income for the 12 months leading up to the flat application date. Half of that figure has to be at most $4,500 for singles to qualify.

- Example Time: If you and your partner made $56,000 last year, your average monthly income is $4,667. Since that’s over the $4,500 cap, the EHG (Singles) isn’t in your wallet.

- So, if you’re earning under $4,500 per month (on average), you’re in the clear.

How the Grant Tiers Stack Up

Below are the grant amounts you can snag based on your income. Remember, these values go down the ladder as your earnings rise.

Couples

| Avg Monthly Household Income | Grant Amount |

|---|---|

| Not more than $1,500 | $80,000 |

| $1,501 – $2,000 | $75,000 |

| $2,001 – $2,500 | $70,000 |

| $2,501 – $3,000 | $65,000 |

| $3,001 – $3,500 | $60,000 |

| $3,501 – $4,000 | $55,000 |

| $4,001 – $4,500 | $50,000 |

| $4,501 – $5,000 | $45,000 |

| $5,001 – $5,500 | $40,000 |

| $5,501 – $6,000 | $35,000 |

| $6,001 – $6,500 | $30,000 |

| $6,501 – $7,000 | $25,000 |

| $7,001 – $7,500 | $20,000 |

| $7,501 – $8,000 | $15,000 |

| $8,001 – $8,500 | $10,000 |

| $8,501 – $9,000 | $5,000 |

| More than $9,000 | NA |

Singles

| Half of Avg Monthly Income | Grant Amount |

|---|---|

| Not more than $750 | $40,000 |

| $751 – $1,000 | $37,500 |

| $1,001 – $1,250 | $35,000 |

| $1,251 – $1,500 | $32,500 |

| $1,501 – $1,750 | $30,000 |

| $1,751 – $2,000 | $27,500 |

| $2,001 – $2,250 | $25,000 |

| $2,251 – $2,500 | $22,500 |

| $2,501 – $2,750 | $20,000 |

| $2,751 – $3,000 | $17,500 |

| $3,001 – $3,250 | $15,000 |

| $3,251 – $3,500 | $12,500 |

| $3,501 – $3,750 | $10,000 |

| $3,751 – $4,000 | $7,500 |

| $4,001 – $4,250 | $5,000 |

| $4,251 – $4,500 | $2,500 |

| More than $4,500 | NA |

Bottom line? If you’re single and your income stays in the golden zone (literally under $4,500 per month on average), you can snag up to $40,000 to help you break into the property market. Keep it under that cap and you’re golden; push above it, and the grant doors close faster than a vending machine breaking on your snack.

Takeaway

- Calculate your average monthly income for the last year.

- Check whether the half of that figure is below the $4,500 threshold.

- If yes, you’re in the EHG (Singles) express lane – congratulations, your new flat is about to become a reality!

Happy house hunting, and may your mortgage payments stay as friendly as your neighbors.

If both applicants are second-timers

Grab a $15,000 Home Upgrade Bonus!

Got your eye on a bigger place? If you’re a couple living in a modest two‑room haven—whether in a subsidised flat or a public rental—there’s some good news for you. The new Step‑Up CPF Housing Grant can hand you $15,000 towards a fresh, snazzier three‑room flat in a non‑mature estate. Think of it as a boost of confidence to step up your game.

Who’s Eligible?

- Couples in two‑room subsidised flats looking to snag a three‑room home.

Enjoy a neat $15k boost. - Those living in public rental flats who want a two‑room Flexi flat in a fresh, non‑mature estate.

You can also qualify for the grant—just like the couples.

The Nitty‑Gritty:

It’s inexpensive to apply, but you’ve got to keep these points in mind:

- Must be a “non‑mature” estate – meaning it’s still on the rise, not a fully mature neighborhood.

- End your current lease before moving – or make sure the landlord agrees you can move out.

- Stick to the CPF‑world – loan plans, payment schedules, and soft‑terms are taken seriously.

Why Even Got It?

Life’s a balancing act. That three‑room split lets you unpack more, manage space, and maybe even host a tiny kitchen. Plus, a few extra dollars could be your ticket to a bigger home, a better location, or a more comfortable lifestyle. It’s not just a grant—it’s a move to more living room, more peace, and less cramped mornings.

Next Steps:

- Check your eligibility – do you meet the criteria?

- Gather paperwork – proof of current flat, passport, slip‑up?

- Contact HDB or your housing sponsor to start the application.

In short: apply, pass the checks, & watch that $15,000 smoothly slide into your hand.

If one applicant is not a Singapore Citizen (Non-Citizen Spouse Scheme)

What the Enhanced CPF Grant Means for You (Singles Edition)

Quick Facts

- Grant Cap: Up to $40,000.

- Income Test: Your House‑Trust account must have at least half of your average monthly income within the past year be no more than $4,500.

How to Check

Grab your last 12 months of income statements, compute the monthly average, halve that figure, and see if it tops out at $4,500. If it does, you’re good to go.

Real‑World Example

Say a couple made $56 000 in the most recent calendar year. Their monthly average is $4,667 (56 000 ÷ 12). Even if they’re single, the cut‑off coins a full $124 per month over the limit, so they’ll fail the eligibility test for the Single Grant.

In short: Only folks earning ~$4,500 a month (or less) keep the doors open.

Want More Housing Tips?

Check out 7 Things to Know About the 2022 BTO Launch Sites for a deeper dive.

HDB grants for couples applying for resale flats

If both applicants are first-timers

Unlocking Singapore’s Housing Grants: The Low‑down

Let’s cut to the chase: buying a flat isn’t just about picking a colour scheme; it’s also about squeezing in those big cash‑in‑hand grants that Singapore gives to help you get that dream home. Below is the quick‑reference cheat sheet (minus the legalese), so you can wing it like a pro.

Family Grant (FG)

- Four‑room or smaller flats: $50,000

- Five‑room or larger: $40,000

What’s the catch? Your monthly household income must stay below:

- $14,000 for you moms, dads or single‑offenders

- $21,000 if you’re hauling the whole extended family into the house (aunts, cousins, your maternal uncle’s side of the bonfire).

Enhanced CPF Housing Grant (EHG)

- Up to: $80,000

- Income check: average gross monthly household income in the 12 months before you submit a resale flat application must be within $9,000.

Think of it as a “grand boost” if your income sits on the lower side of the scale. It’s a sweet way to pad your savings up front.

Proximity Housing Grant (PNG)

- If you’re planning to share a roof with parents or kids: $30,000

- If you’ll be chilling within 4 km of them: $20,000

And here’s the cool part: whether your family lives in public housing or a fancy high‑rise private edifice doesn’t matter. There’s no income ceiling on this grant; it’s all about proximity, literally. Sort of like “if you’re close enough, we’ll give you the support you need.”

Bonus Tip

Keep a little spreadsheet handy—track your monthly income, and you’ll be able to see at a glance whether you qualify for the FG or EHG before you even think about putting your fill-in your eyes on another resale flat. The better you plan, the smoother the application, and the sooner you’ll be flipping those big keys into the house you love.

Income criteria for EHG:

Step‑by‑Step Guide to the EHG

Ready to hop onto the resale flat train? Here’s the low‑down on how to get the EHG card sorted:

- One year of steady work: At least one member of your application team has to have been on the payroll for a full 12‑month stretch right before you throw in your bean‑bag of the flat application.

- Still on the job: The same member must still be ringing the bell—i.e., working—when you press submit.

Think of the EHG like a loyalty badge: you need the solid year‑long work lap before paying the entrance fee. Once you meet those two checks, the rest of the process is a breeze.

One applicant is a first-timer, and the other is a second-timer

Half‑Housing Grant: Your Quick Cheat Sheet

Got a dream of snagging a new flat but feeling the weight of the rent bill? Lucky you—there’s a grant that could cover a large chunk of that upfront cost. Here’s the scoop, broken down for you in plain English.

What’s the Grant All About?

- Four‑room flats or smaller: Up to $25,000 can be lifted from your wallet.

- Five‑room flats or larger: The grant tops out at $20,000.

Who Qualifies?

The grant is geared toward families that keep their monthly income under a certain ceiling.

- Regular Household: Monthly income must stay below $14,000.

- Extended Family Applicants: The threshold rises to $21,000.

Wanna know if you’re on the right track? Simply compare your monthly earnings to these caps and you’ll know. If you’re still on the fence, just double‑check the official eligibility criteria—it’s all about staying within those numbers.

Why Should You Care?

Roomier living doesn’t have to mean richer expenses. This grant cuts down a big portion of that initial cost splash. Think of it as a financial “cheers” for every family ready to move up to a better space.

Feel the excitement? Grab your paperwork and let the grant do the heavy lifting—your future home awaits, and the financial pinch can be a little less intense.

For applicants who have previously received a Singles Grant

What’s the Deal with Top‑Up Grants?

Big news for families looking to buy a new home: you can chip in the difference between what you’re entitled to and what you’ve already received (think the Single Singapore Citizen Applicants scheme). That’s the Top‑Up Grant. It’s only available if your monthly household income tops out at about just $14,000—so keep your bank balance modest.

Exception for Changing‑Circumstance Couples

- If you’re a Singapore Citizen or Permanent Resident and your spouse has just become a full‑blown Singaporean citizen, you’re eligible for a special Citizen Top‑Up Grant of $10,000—with no income cap at all.

Sidekick Grants You Can Team Up With

Besides the Half‑Housing Grant or the Top‑Up Grant, many couples can add a sweet bonus: the Enhanced CPF Housing Grant (EHG), which usually comes to the rescue for singles.

How the Grant Is Calculated

- Your grant scales with your income, but there’s a ceiling of $40,000.

- Get half of the average gross monthly household income, but that number has to sit below $4,500.

In short, if you’re in the right income bracket, you could get a significant splash on your home budget. Reach out to your housing office or check the official portal for more details—and keep that spreadsheet ready!

For applicants buying a resale flat to live with their parents/children or within 4km of their parents/children:

Proximity Housing Grant (PHG)

Ever felt like you’re stuck at home with the same couch you’ve had for years? The Proximity Housing Grant gives you a chance to upgrade without breaking the bank – and a little extra for your mom or kiddo.

Check the Bonuses

- $30,000 if you’re living right next to your parents or children.

- $20,000 if you’re living within a 4 km radius of your parents or kids.

Why it’s a win

Sharing a home means sharing the rent, chores, and occasionally the mystery of the missing sock. With the grant, you double the savings and make “family living” feel more like a cozy deal than a cramped arrangement.

If both applicants are second-timers

Step‑Up CPF Housing Grant: Up to $15,000!

What’s the Deal?

The Step‑Up CPF Housing Grant is Singapore’s way of saying “Hey, we want to support you in grabbing that next‑level home.” It gives families cash to help offset the cost of stepping up from a smaller flat to a bigger one.

Who Gets the Grant?

Couples in Small E‑Spaces

- Living in a two‑room subsidised flat (or a public rental flat) in a non‑mature estate AND want to buy a resale three‑room flat in the same type of estate.

Singles in Rent‑4‑Resale

- If you’re living in a public rental flat and looking to buy a two‑room resale flat in a non‑mature estate, you’re also in the running.

In both scenarios, the grant can be up to $15,000, easing the financial pinch of buying a bigger home.

Why It’s a Good Idea

- It beats the mortgage down payment fee—no extra hunk of cash from the bank.

- It encourages upgrading to a bigger living space while staying in the same neighbourhood.

- It helps you avoid the headache of moving to a mature estate (where prices sky‑rocket).

Heads up: the grant is only available for resale flats in non‑mature estates. If the estate is mature, the grant doesn’t apply. Keep that in mind when you’re hunting for the perfect home upgrade.

How to Get Started

- Confirm you fit one of the eligibility groups.

- Talk to your bank or the HDB (Housing & Development Board) about how the grant can be applied.

- Make sure you have your CPF savings ready to cover the grant amount.

Got it? Great! Now you’re one step closer to unlocking that extra space and making your home feel a bit more, well… yours. Happy house hunting!

What if one of the applicants has yet to graduate/ORD from National Service?

HDB’s New Income Assessment Flexibility for BTO Applicants

Gratifying Good News for NSFs, Students & Couples

Starting from May 2018, the Home Development Board (HDB) has handed out a storm of relief to those kicking off the Build-To-Order (BTO) journey—full‑time National Service men (NSFs), students aged 21 and above, and couples—allowing them to postpone income verification until the moment they pick up their keys. No more rushed paperwork stress!

- Full‑time NSFs – enjoy the chance to delay income checks until key collection.

- Students 21+ – your earnings can wait until the day you receive your keys.

- Couples – still qualify for the Enhanced CPF Housing Grant (EHG), even with the deferred assessment.

In essence, this change releases you from the pressure of immediate income proof, letting you focus on the exciting part: moving into your brand‑new home. Curious about the specifics? Head over to HDB’s official site for more info on the Deferred Income Assessment and how it can ease your housing journey.

How will the HDB grants for couples be disbursed?

Your Housing Grants: What Happens to Them When You Move?

Think of the grant as a trusty side‑kick that stays right by your side – it never turns into pocket cash. Instead, it gets tucked neatly into your CPF accounts. Let’s walk through the journey in plain, friendly terms.

How the Grants End Up in Your CPF

- All grants land in your CPF Ordinary Account (CPF OA) – that’s the default spot for every Singapore citizen who qualifies.

- For married couples, the grant splits evenly between the two partners’ CPF OA accounts. Fair play!

- There’s no cash hand‑over. The grant stays inside your CPF, not in your bank drawer.

When You Sell Your House: The Reciption Roll‑call

Hey, if you decide to part ways with your home, you’ll need to give back the grant (plus the interest that piled on while you owned it). That’s just in addition to any CPF savings you’ve already spent on the purchase.

Credit Back – It’s a Two‑Part Deal

- The first $60,000 of the grant goes straight back into your CPF OA account.

- The remaining amount winds up in a combo of your CPF Special Account / Retirement Account and Medisave Account.

In short, your grant stays locked inside the CPF ecosystem, popping up in the right accounts when it’s time to pay it back. It’s like a secret savings vault, only accessible when you actually need it.