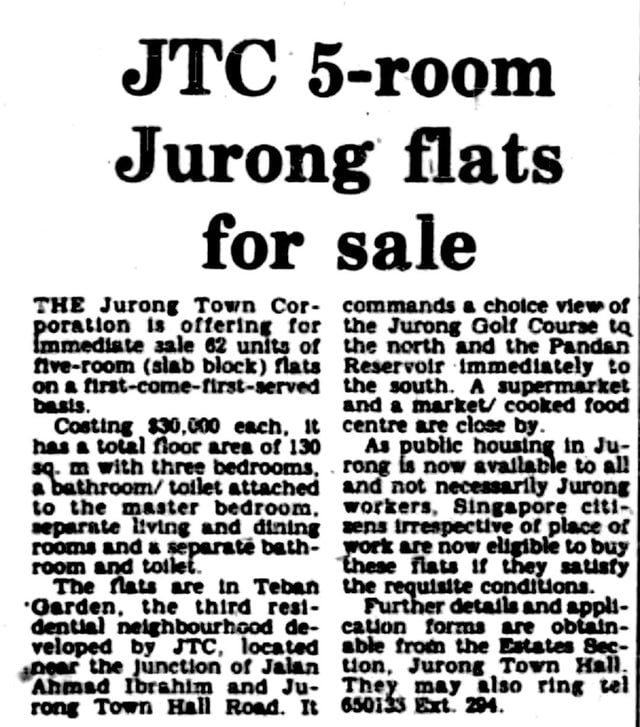

Remembering 1977: Singapore’s Classic 5‑Room Flats Make a Comeback!

Hey, #Singapore lovers! A Reddit post just threw back the decades, showing a 1977 newspaper clipping that reveals JTC’s five‑room flats were up for grabs in Jurong. Let’s take a quick tour of the old‑school real estate that once minted the next generation of GIC board members.

Where It All Happened

- Location: Teban Gardens, right at the crossroads of Jalan Ahmad Ibrahim and Jurong Town Hall Road.

- Sale! All 62 units were listed in a first‑come, first‑serve frenzy.

- Price per unit: A nostalgic $30,000.

The Classic Layout (because old is gold)

- Floor area: 130 m² (or 1,399 sq ft) – not your modern tiny apartment, but plenty of “back‑to‑back” space.

- Three bedrooms – smooth transitions to the master, spartan or Queen‑size, and the one you can’t quite remember your name for.

- Bathroom perks: Master bedroom with its own attached toilet; plus a common bathroom for the rest of the crew.

- Separate living & dining rooms – because hosting friends never looked so classic.

Price per Square Foot

With a price tag of $30,000 for each unit, that’s roughly $21.44 per square foot – a figure that might make your current rental market look pricey!

Time travels a bit, but the spirit of 1977 Singapore still lives on. If you can’t resist a nostalgic real‑estate trip, let us know which era of Singapore you’d like us to bring back next! Stay tuned – maybe the 1980s’ “gum‑tree” condos or the 1990s’s “megaplex” apartments will drop their stellar news in the near future.

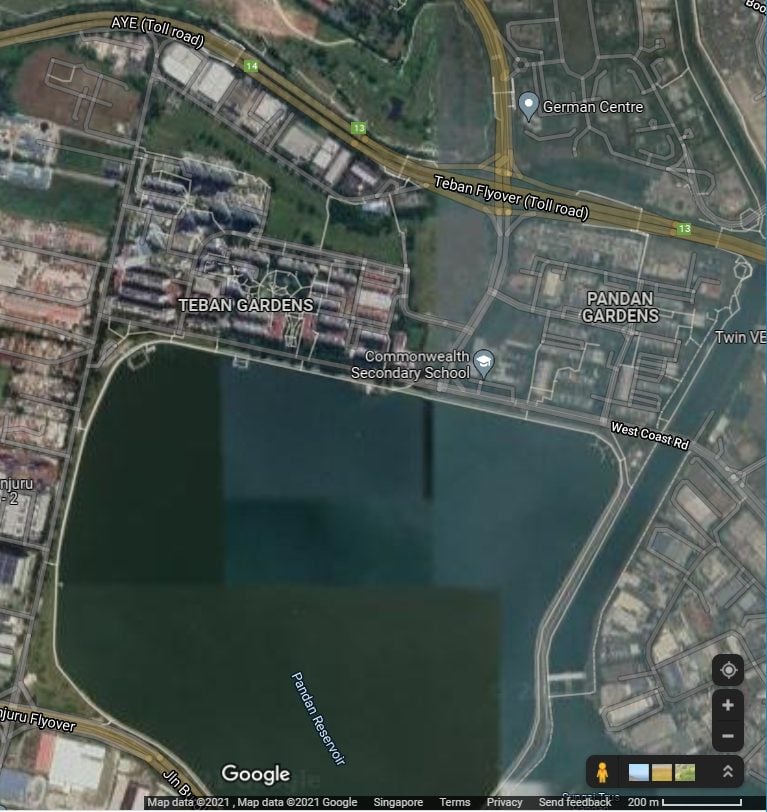

Picture This: Singapore’s Hidden Gem in Teban Gardens

Ever stroll past Pandan Reservoir and catch a glimpse of a quiet residential stretch? That’s exactly where the story unfolds – right between the lush greens of Jurong Golf Course and the serene waters of the reservoir.

Where It’s All Happening

Imagine B‑the‑Teban-area as this little slice of paradise:

- North side: Jurong Golf Course – a perfect backdrop for sunrise jogs.

- South side: Pandan Reservoir – a calm spot for paddle‑boat lovers.

If you’s ever hiked through Teban Gardens or ridden the AYE tram past Penjuru Road, you’d notice:

- To your right you’d spot the waters of Pandan Reservoir.

- To your left—the old HDB block houses, some of which date back to the ‘60s & ‘80s.

Old‑School Homes, New‑Age Charm

The 1977 news piece mentioned several old buildings that, over the decades, either got demolished or received a fresh coat of paint. Still, the neighborhood preserves a handful of “classic” flats:

- Four blocks erected in 1977—still standing at this very moment.

- More units from the late 60s through the mid‑80s—each with its own story.

Picture a mixture of heritage charm with modern conveniences—all set against a backdrop of green tranquility.

Caption 100% Real Life

Photo: r/Singapore Reddit – capturing the picturesque serenity of Tegan Gardens’ streets.

That’s the scoop: a little slice of Singapore that’s as pleasant as it is quiet, with a lineage that taps right into the city’s classic residential vibes.

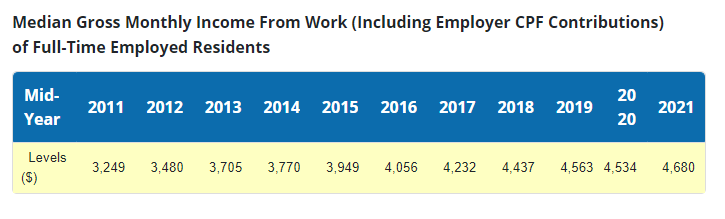

What the Numbers Really Tell Us

Ever wondered how a 1976 paycheck stacks up against a 2021 wage? A curious thread on Google Maps got people chatting about it.

- 1976 “average worker” salary: about $340 a month, according to a Ministry of Culture press release.

- 2021 median gross monthly salary: a whopping $4,680.

- Ratio: 13.76 times higher—nice math, but does that mean a $100k house in ’76 is the same as a modern five‑room flat?

Users joked that the 13.76× factor could be the missing link to explain today’s pricey apartment market. If you scale a $200,000 home from 1976 by that same factor, you land in the ballpark of the current $2.75 million price tag for a five‑room flat.

Bottom line: a nostalgic glance at the past, a splash of spreadsheet wizardry, and a quick reminder that money never stops relating to the clock.

Housing Market Snapshot: Pandan Gardens & Beyond

Where the Numbers Fly

So, imagine a five‑room HDB flat — the sort of place that could comfortably fit your entire family and maybe even a small hamster (if that’s your thing). This gem, located just next to Pandan Gardens, went from off the market to being sold in November 2021 for a whopping $450,000, which works out to about $323 per square foot.

Quick Throwback: 1986’s Delight

Completed back in 1986, the unit spanned 1,389 sq ft and sat comfortably between the 10th and 12th floors. With that size, it’s easy to picture a “home office” that could also double as a small theatre.

The Price‑Hike Rollercoaster

- From 1977 to 2021, the price didn’t just go up a little; it climbed 15×. Pretty much, what was considered “cheap” in the 70s has become “wealth‑building gold” in the 2020s.

- If you line up the median salary growth against the rise in resale prices in the same area, they’re dancing to the same beat — almost a perfect sync.

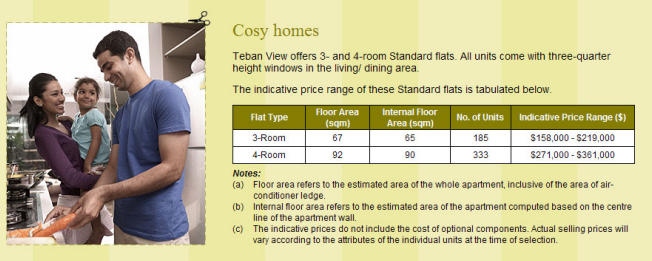

New Playhouse: Teban View

Fast forward to the newer side of town – Teban View. This BTO development hit the market in September 2011 and was finished in 2016. Here’s the price breakdown that made a lot of people smile (or gasp):

Three‑Room Comfort

- Indicative price range in 2011: $158,000 to $219,000.

- Size: 67 sqm (about 721 sq ft).

- That translates to roughly $219 per square foot.

Four‑Room Marvel

- Indicative price range in 2011: $271,000 to $361,000.

- Size: 92 sqm (around 990 sq ft).

- Price per square foot falls between $219 and $365.

Why All This Matters

In the end, whether you’re buying a classic Pandan Gardens unit or a newer Teban View flat, the takeaway is simple: the Singapore housing market is a rollercoaster. As salaries rise, so do resale prices – a near‑perfect match that makes every trip to the Property Studies Office feel like a walk down memory lane, while also hinting at the future.

So next time you’re scrolling through listings, remember: the price tags may look intimidating, but they’re just the latest entry in a long, thrilling saga of homeownership in Singapore.

What’s the Story Behind Teban View’s Price Jump?

Grab a coffee, because the numbers are about to get wild. In 2011, the median gross monthly salary was a whopping $3,249—a full 9.56‑times increase over the $340 you’d earn in 1976. That’s money‑talking progress.

From Buckles to BTO: Dollar‑to‑Dollars in PSF

In 1977, a BTO flat cost only $21.77 per square foot. Fast forward to Teban View, and you’re looking at $219 to $365 per square foot—a mind‑blowing 10‑ to 16.8‑times jump.

- Why the Gap? Simple: salaries rose, economies grew, and the cost of living got a major bump.

- Not a Copy‑Paste: The 1977 JTC flats rode on a different rulebook than today’s HDB policy.

Things like eligibility, grants, loan rates, CPF contributions, inflation, and consumer prices change a lot over time. - Size Matters: The average BTO flat in 1977 was snappier than the ones you see now, but it’s also a whole lot cheaper per square foot.

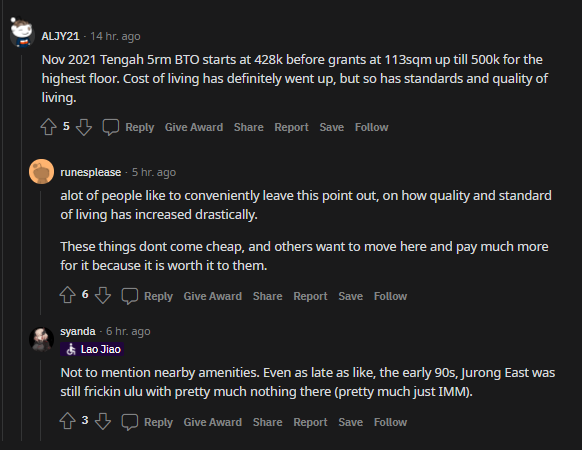

Reddit “Flat Size Fiasco”

On a lively Reddit thread, users complained that newer BTO homes seem smaller in real terms, even as the price per square foot keeps climbing. It’s the classic “fewer inches, higher price” headache.

Bottom Line

It’s not just about a few extra dollars. The financial landscapes, construction norms, and housing policies have evolved. And while the numbers show a dramatic rise, each flat’s actual value still depends on its location, amenities, and the glorious politics of Singapore’s new era.

When Teban View Re‑Energizes Its Housing Market

Imagine living in an apartment that ages like a fine wine – the older it is, the sweeter the deal you can get. That’s exactly what’s happening in Teban View after the MOP back in 2021. The numbers? They’re telling a story that’s more exciting than a mystery novel.

Current Play‑By‑Play

- Average resale price: $524 per square foot for those three‑ and four‑room HDB flats.

- Launch price comparison: In 2011, the same flats kicked off at roughly $372–$511 per square foot.

- Jump in value: That’s a big leap – anywhere from a 44% rise to a 139% spike over a decade.

- Why it matters: The flatter with a longer lease tends to club higher resale prices, as if the ceiling just keeps getting higher.

Coincidence or Cosmic Alignment?

Hold onto your wallets: the 44% increase in median gross monthly salary from 2011 to 2021 lines up perfectly with the lowest end of the resale price hike. It feels like the city is whispering, “Keep hustling, you’ll be rewarded.”

Why Newer Means Newer Value

In a world where time often erodes value, Teban View flips that trend. Apartments with a fresh lease and fewer years left on the clock turn into golden copper in the resale market. If you’re buying, it’s like picking a fruit that’s still in season versus one that’s rotting away.

Takeaway

If you’re eyeing a home in Singapore, especially in Teban View, remember the timeframe matters. The longer the lease still gleaming, the hotter the resale price. So buckle up – the real estate market’s got a swoop that even the stock market can’t compete with!

From 1977 to Today: The Big Jump in Teban Gardens Home Prices

Picture this: a humble apartment in Teban Gardens back in 1977, priced around $524 per square foot. Fast‑forward to the present day, and that same square foot is worth roughly $12,576—a 24‑times surge. That’s a staggering leap, particularly when you pair it with the 13.76‑times rise in median monthly salaries over nearly the same period.

What the Numbers Really Mean

- Since late 2020, the average resale price per square foot has climbed by 15.40%.

- A single 1977 unit that cost just turns into a modern gem worth up to $40,000.

- Even the largest, newest apartments in the same neighborhood now fetch prices that outstrip the earning power of many of their ancestors.

Why It Feels Like a Shock

Imagine your great‑grandad buying a modest flat for peanuts, then your granddad making a similar deal with a modestly higher price. Fast forward to today and you are eyeing a brand‑new, spacious unit and you’ll find yourself paying not only more per square foot but also paying it against a wage that’s increased at a slower rate.

The Real Takeaway

So, in plain English: If you’re looking at Teban Gardens now, you’ll likely pay the price of a 1977 homeowner—and that’s before you even consider grants, interest rates or taxes. What’s more, the money you earn is far behind the price you’ve got to shell out. That’s the headline news, and it’s no surprise why people are scratching their heads the way a cat scratches when it hits a wall.