Singapore’s Wealth Surge: Millionaires Rising, Cash Stacks Growing

Good news for high‑rollers! Singapore’s rank on the global millionaires ladder shot up with an 11.2 % jump over the last year, making 183,737 folks officially wealthy.

What the numbers really mean

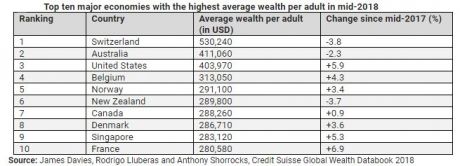

- Average wealth per adult climbed 5.3 % to just over US$283,000 – a staggering ninth‑place spot worldwide.

- Household wealth swelled 7.4 % to roughly US$1.3 trillion.

- “Crazy rich” agents (over US$50 million each) numbered around 1,000, a 1.1 % boost.

Why the house‑hold wealth is on the rise

From 2000 to 2018, per‑adult wealth climbed more than 146 %, thanks to:

- Supreme savings habits.

- Rising asset prices.

- A helpful swing in the currency during 2005‑2012.

Finance‑first households

Financial assets account for 55 % of Singapore’s gross household wealth – a ratio that even matches the Swiss, known for being the world’s wealthiest per‑capita economy.

Future outlook

Credit Suisse projects that the millionaire population will keep growing at a steady 5.5 % annually for the next five years, hitting roughly 239,640 by then. Meanwhile, trusty average debt sits at merely US$53,000, a modest 16 % of total assets for a nation packed with cash.

Bottom line: Siolders, the city-state’s wealth economy is booming – a perfect testament that with a mix of savings, smart assets, and a bit of good luck, the silver lining is literally jacked-up!

Global Wealth on an Upward Trajectory, 2023

In a nutshell: the world’s fortunes are climbing. Global wealth leapt 4.6 % to a whopping US$317 trillion over the last year, outstripping the population surge. On a per–adult basis, the average global wealth hit a new high of US$63,100, thanks to a 3.2 % rise.

Who’s amassing the most?

- United States – added US$6.3 trillion, nudging its total up to US$98 trillion. Since 2008, the U.S. has kept winning the annual growth race for both total wealth and wealth per adult.

- China – following closely, adding US$2.3 trillion and reaching US$52 trillion. Analysts predict another US$23 trillion boost over the next five years, positioning China to own 19 % of global wealth by 2023.

- Other major players include Japan, Australia, Korea and Taiwan—together accounting for more than 8.8 million millionaires.

Where is the growth coming from?

Outside of North America, the surge is driven mainly by non‑financial assets: real estate, art, collectibles, you name it! In China and Europe, these assets contributed a solid 75 % of wealth growth; in India, they actually made up 100 %.

Worrying and Winning

John Woods, Credit Suisse’s Asia‑Pacific chief investment officer, called the U.S. and China the “obvious outperformers”, “even with rising trade tensions.” He noted that volatile asset prices and currency swings had the biggest bite out of wealth in Latin America and parts of the Asia‑Pacific. Picture this: when the dollar tanks, wealth trends in Australia and India feel the pinch just the same.

Asia‑Pacific’s Big Share

Asia‑Pacific, including China and India, topped the chart as the largest wealth region. Household wealth climbed 3 % to over US$114 trillion, pulling the region into the 20 % club of global millionaires.

The Bigger Picture

Credit Suisse forecasts a steady rise of nearly 4.7 % in global wealth every year over the next five years, expecting a bedrock of US$399 trillion by 2023. The report also dives into women’s wealth outlook and the shrinking gap between the top tiers and the bottom two of the wealth pyramid—a bright spot for inclusivity.

Takeaway

While the world’s galleries, vaults, and palm trees seem to be growing in wealth, the story’s not just about the rich. It’s about how people are reshaping the economic canvas, and how the axis of money shifts toward new regions and new kinds of assets.