Singapore’s New GST Rules—Everything Hits the Same Pay‑wall, Even Your Sofa!

Yesterday, the Budget dropped the big-ticket apology: GST goes from 7 % to 9 %. But while the headline headline flies high, the real surprise that’s already in full swing is the GST on imported digital services—starting 1 January 2020. I know what you’re thinking: “What’s this sudden tax dragging my streaming and apps into the tax side‑line?” Let’s break it down.

Which of Your Favourite Favourites Now Come With a Side‑serving of GST?

- Netflix & Watching Cinema – Yes, every binge‑session now carries that 7–9 % delta.

- Spotify Melodies – Your playlists? Charged up, literally.

- Google Play & Apple App Store – even those mini‑apps you swipe for a quick game have that extra tax.

- Loot Boxes in Over‑Witch‑YOU – Got that click that pops a surprise ?? you’ll now see the GST emblem on the billing screen.

- Online News & e‑mags – Paperless? Yes. Gold‑cheeked? Absolutely!

- Digital Cloud Storage – Keep your photos safe and pay a little for the service.

- Remote Education Tools – Class goes digital, the bills go real.

Meet Your New “Monthly Tax Shopper”

Picture this: receiving a bill that says, “Your Digital Consumption for April is $60.00 (incl. GST).” That’s approximately a 7–9 % bump on every digital service you use—just a spreadsheet smile to remind you that the taxman’s favourite sweet spot is your streaming & app habit.

Which of you are ready to feel that surge in your wallet?

It’s one of those government measures that will slowly warp the way we think and use digital goods. Nothing fancy, just a little extra on the paying end—because Singapore’s GST doesn’t just tax physical goods, it’s now streaming with a stern roar!

So, next time you click “Buy” or “Subscribe”, remember—one part of that payment goes to the government. Honestly, it’s a comfortable, subtle reminder that taxes are not just for the old folks but also for the young influencers spiraling in the digital arena. Cheers to that, and cheers to staying power for your net-worth, guys!

Big Blessing? Small Bother? How GST Might Slide Into Your Digital Life

Picture this: you’re scrolling through your playlist on Spotify, blasting the latest blockbuster from the WWE Network, or snagging a sweet Loot Box in Overwatch. All that fun is about to get a tax‑y twist, because GST will creep into every digital pocket the government can find.

Where the Tax Storm Is Gonna Be Scented

Microsoft’s Steam, Apple’s App Store, Amazon’s Kindles, the fine world of online gaming micro‑transactions, and even that small monthly fee you tip at Skype—yes, that too. They’re all up for GST between 2020 and 2021.

And guess what? The foodie duo that runs your Uber rides might soon find a VAT‑ish notch in their bill, because the regulators are squinting at it as a “digital service.”

European Union’s Love Election of E‑Books

- In the EU, e‑books are taxed more steeply than paperbacks.

- UK: 20% for e‑books vs. 0% for physical ones.

- Germany: 19% for e‑books vs. 7% for hard copies.

Down Under, GST Hits 10% on All Digital Streams

- Australia: July 2017 rolled in a 10% GST on digital services—think digital newspapers, online clubs, and dating apps.

- Ticketing services like Eventbrite? 10% GST.

- Bitcoin? No GST now.

Japan’s 8% Digital Consumption Tax

- Applies to everything from e‑books to cloud‑based services, plug‑in apps, streaming media, and online gaming.

- Voice & data telephony stays exempt.

Businesses: Primaries & Secondary

First, local firms selling services straight to you could face GST if:

- Global turnover > SGD 1 million.

- Digital sales to Singaporean customers > SGD 100 000.

Only about 100 such firms seem to fit that bill, according to estimates.

Second, B2B‑service providers—think cloud‑based HR systems, sales funnels, etc.—could add GST on their offerings. Roughly 1,000 of them might be on the tribute list. That could trickle down like a waterfall to the end‑consumer.

Gaming – The “Pay‑to‑Win” Paradox (now +2% GST)

Casual gaming gives rise to those micro‑transactions that make you wish you had a bigger wallet. Free‑to‑play titles like Candy Crush offer extra lives if you’re willing to drop a few dollars.

Now, if you’re in “pay‑to‑win” scenarios (where the richest players dominate the leaderboard), the extra 2% GST on Loot Boxes pushes the cost a bit higher for paying players. In most balanced games—like Overwatch—the loot spawns randomly, so less money = no advantage. Once GST arrives, the extra $2 for a 24‑loot‑box pack might feel like a tiny sacrifice—especially if you’re buying “skins” or “hero upgrades” at a gog‑budget.

Hope Drum Roll: No Increase in Pay‑to‑Win? Reality Check

Good news for players who prefer Not‑Pay‑to‑Win modes: With GST in place, there might be fewer “pay‑to‑win” movers. Small win for the under‑spenders.

Preparing Your Digital Paycheck

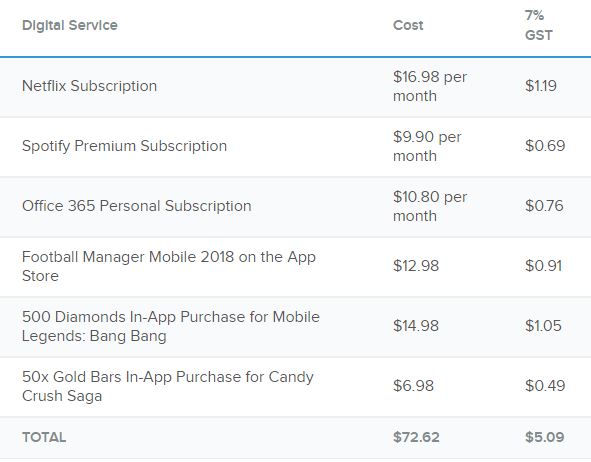

Coming 1 January 2020, you might want to track how much you’re actually spending on digital services. Let’s break it down.

- Subscriptions: ~20 SGD/month each.

- If you’re juggling 4-5 of them, you’re at ~70 SGD/month. Add 5 SGD/month GST and you’re looking at a 60 SGD annual jump.

- Think: Keep the ones that mean “you”, and ditch the others.

In-App Purchases – Pause & Think

If you love buying hero skins or in‑game “loot,” consider lingering in the game for a while to earn Loot Boxes naturally. You might avoid tweaking the app store but still get that epic character.

If your favorite game’s entirely “pay‑to‑win,” maybe it’s time to find a new hobby. The world has plenty of free‑to‑play options.

Pay‑Back & Cash‑Back Schemes

Netflix & Spotify Premium—yes, those are still worth the subscription. Just make sure you pay with an online credit card. For example, a DBS Live Fresh card offers 5% cashback on online spend. It won’t wipe out GST, but it lighter the load.

Also, consider hugging a café corner; after GST goes from 7% to 9% soon after, maybe the extra caffeine is a good way to offset the tax?

Final Thoughts

GST on digital services is not a mystery but a march that’s likely to hit most streaming, gaming, and app‑based services. While it raises a few eyebrows—especially for those who game or binge‑watch—it also nudges us to evaluate the true value of our subscriptions. Think before you click “buy” because the tiny extra charges might add up, and, indeed, the “pay‑to‑win” crowd may feel the sting a bit less.

Stay savvy, keep your digital appetite in check, and perhaps even farm those Loot Boxes on autopilot to dodge that subtle GST sticker.