How Many Subscriptions Are Sneaking Into Your Wallet?

Ever noticed how your bank statement looks like a subscription buffet? Netflix, Spotify or Apple Music, food‑delivery crate‑subscriptions, and the occasional airline club—it’s like a mini‑retail chain in your pocket! It’s time to do a tidy-up.

Why Monthly Subscriptions Make Sense

- Fixed fee, fixed satisfaction. Pay once a month, use it as much as you want.

- Automation is your best friend. No more “Did I something?” checks—just our friendly dial‑up auto‑renew.

- More usage = more value. The more you use, the less the cost per snack or song.

Food & Drink

Think of every meal as a mini portal to a subscription‑store: FoodHub and MealKit are the champagne of drizzles.

- FoodHub Prime – Unlimited “take‑away” toppings for 29 SGD/month.

- MealKit Plus – Kitchen kit’s buffet for 45 SGD/month.

- Smart trick: Share the bill with your roomie, and you both get 10% off.

Transport

From scooters to express plane vibes—transport subscriptions are as sticky as your sticky notes.

- Grab Unlimited – Unlimited rides for only 25 SGD/month.

- Alaska Frequent Flyer – 70% cheaper for any flight costs, if you travel often.

- Bundle all your transport apps and you might half your cost if you’re on a money‑saving spree.

Entertainment

Music, movies, games—yes, those are a core part of your salary sheet.

- Spotify Premium – Call it your personal radio for 15 SGD/month.

- Netflix Premium – Thousands of films plus a monthly cost of 30 SGD.

- Sharing your account with a couple of friends knocks your cost down—everyone gets the same hits for a smaller chip.

Shave Some Buck: Bundle & Share

Here’s the secret sauce: Bundle deals are like a magical vending machine for savings. Typically, the more you bundle in one go, the more your budget flexes down. Even spontaneous efforts like sharing subscriptions with your mates can give you the pinch you need.

- Cross‑refer your food/lunch and transport deals – you might snag the “Super Saver” package that drops you 12 SGD.

- Share entertainment accounts; e.g., 4 people = 4/4 of the bill, but the cost for each is less than the original price.

Bottom Line

If you’re a fan of minimizing the “portfolio” of recurring payments, it’s all about bundling and sharing. Grab a couple of freebies, share your playlists, and you’ll have more cash in your pocket for dessert or a spontaneous jazz club visit.

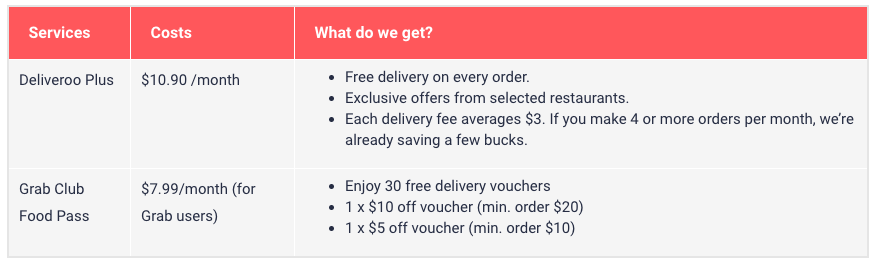

Looking to Save on Food‑Related Memberships? Here’s the Low‑down!

Let’s cut to the chase: these memberships only make sense if you’re grub‑hungry on a regular basis. If you’re not ordering a bunch of takeaway, you’re probably better off keeping your wallet sticky.

Grab Food – The Ride‑and‑Dine Combo

Think of it as your all‑in‑one ticket to tasty meals and smoother rides. Swipe the GrabPay button, and you’ll rack up GrabRewards that can be swapped for ride vouchers. So, every time you order, you’re basically getting bonus miles for your next bus or taxi hop.

Grab with SCORE – 10 Free Delivery Vouchers Monthly

“Hooray for free deliveries, but no Discount vouchers from the Club Pass!”

- Get 10 free delivery vouchers per month (if your order hits $20 or more).

- No extra discount perks from the Club Pass.

- Great if you’re okay with paying the full fare but still want to kick the delivery fees to zero.

Bottom Line – Pick the One That Fits Your Food Life

If you’re a frequent rider and love grabbing food straight from your phone, Grab Food is your best bet. Want a bit of cashback on deliveries without the extra fuss? Grab with SCORE is the deal. Either way, you’ll be saving more than you spend (provided you keep eating out a lot).

Happy munching, and may your delivery slip be free of charge!

Make the Most of Your Food‑and‑Lifestyle Deals

Burpple: The Wallet‑Friendly Hero

Burpple is often praised for being the go‑to for money‑saving junk food lovers. Two key reasons explain why:

- Lower annual fees – unlike its competitor, Burpple keeps the yearly cost at a more comfortable level.

- Wide selection of popular food & beverage outlets – you’ll find more beloved spots to snatch those 1‑for‑1 deals.

The Entertainer: More Than Just Restaurants

While the Entertainer also offers 1‑for‑1 deals at restaurants, it expands beyond the kitchen to include:

- Beauty & cosmetics discounts

- Shopping vouchers

- And even offers occasional free upgrades or extra perks.

Because of this broader spectrum, you’re more likely to break even if you use it across different categories. Food deals are the star performers, but the extra categories help you level up quicker.

Free Membership Bonus

If you’re an HSBC credit‑card holder, you can snag a complimentary Entertainer membership – no annual fee required!

Quick Takeaway

Choose Burpple if you’re all about the food savings and want a simpler, more cost‑effective plan. Opt for The Entertainer when you plan to shop, enjoy beauty deals, and want a broader loyalty experience. Happy saving, and enjoy those tasty treats!

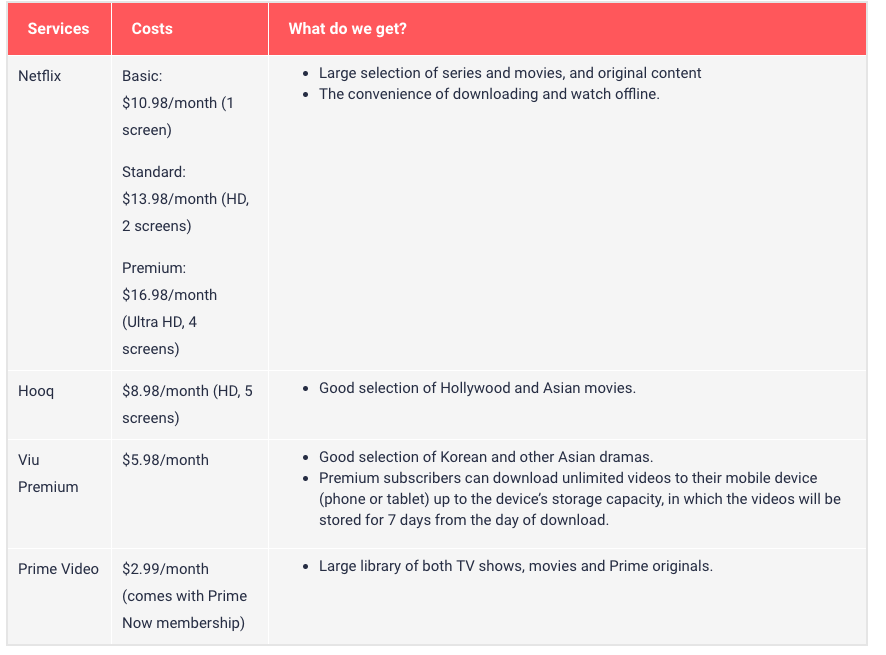

How to Save on Your Streaming Subscriptions (Because Who Wants to Pay More Anymore?)

Photo: Shopback

Every streaming binge-happy person has a secret stash—how to get your favorite shows for less. Below are the juicy tricks that let you keep your credit card happy while still getting all the entertainment you crave.

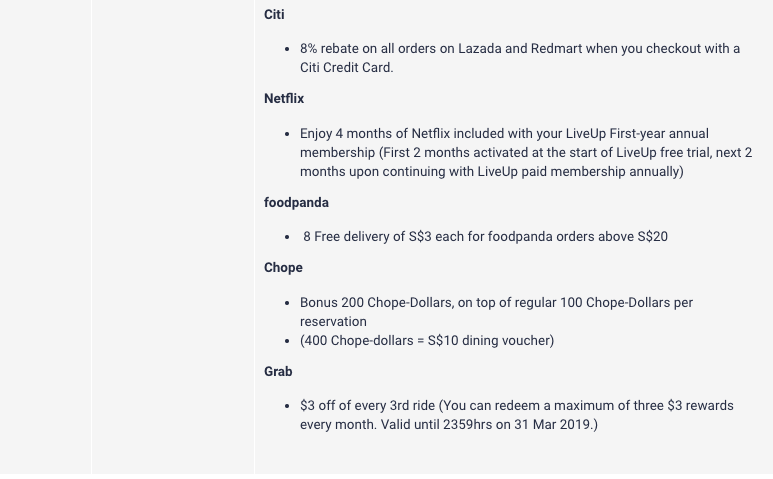

LiveUp Membership = Free Netflix

- What’s the deal? Grab a LiveUp membership program and you’ll walk into the world of Netflix for free—just for four months.

- How it works:

- The first two months are already on us when you start your LiveUp free trial.

- The next two months kick in after you upgrade to the yearly LiveUp plan.

- Why it’s cool: No credit card scares—just pure Netflix vibes.

Singtel Cast + Viu/Hooq = Discount + Free Months

- Set it up: If you’re a fan of Viu or Hooq, Singtel Cast is your go-to. You’ll get a two-month “freebie” on either service.

- Monthly price? It’s a sweet $4.90/month after you lock in a 12‑month contract.

- Who can snag this? Only Singtel Postpaid Mobile, Fibre Broadband, and Singtel TV customers. If that’s you, you’re in the club.

- Pro tip: Treat it like a subscription for your kids—“That’s the price of let’s binge together!”

Netflix Premium = Family Share = Savings

- Price point? $204 per year is the upper limit, but figure it out in the family way:

- Invite three other family members to split the bill.

- Each person pays for a slice—all four screens now streaming happily.

- Why share? No more “who’s streaming what” drama. Bonus: everyone gets the same premium experience.

Bottom Line: Win-Win

- You get hot shows and movies.

- You keep the budget intact.

- Everyone in the circle gets the streaming advantage.

So go ahead— grab the discount, haul the free months, and turn that streaming dream into a budget-friendly reality. Your bank account will thank you, and your binge sessions will have never been more worth it. Enjoy the shows, and let the savings roll in!

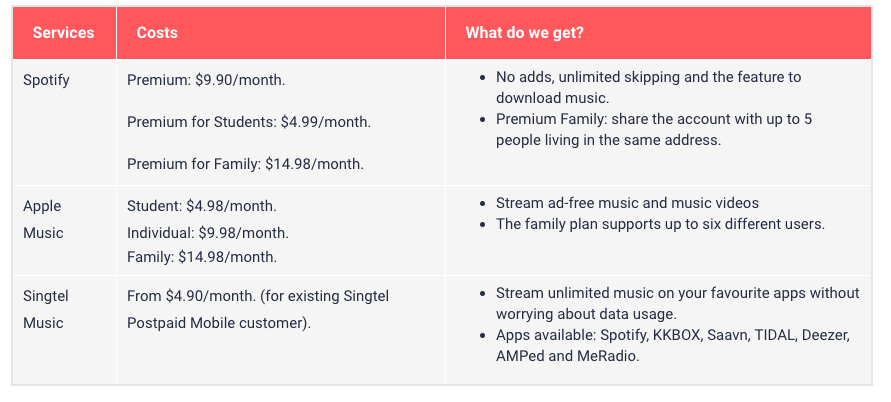

How to Cut Those Music Subscription Costs Like a Pro

Ever wonder how to enjoy unlimited tunes without breaking the bank? We’ve got the scoop on the best ways to get that sweet, sweet streaming bliss while keeping your wallet happy.

Spotify Family: Share the Beat (and the Bill)

Grab Spotify for Family—they let you buddy up with up to six people living at the same address.

Here’s the kicker:

- Split the yearly price — you’ll only pay $30 per person for a whole year of ad‑free music.

- Download hits to your phone and slash your data usage. No more numbers scrolling like a bad GPS.

- End of story: you’ll never have to ask your friend if you can hear those oldies-on-repeat.

Singtel Music: Your Passport to Unlimited Sound

If you’re a Singtel user, take advantage of their unlimited music pass through partner apps (Spotify, KKBOX, Saavn, TIDAL, Deezer, AMPed, MeRadio) for just $4.90 a month. (Spotify alone would normally cost $8.90, but Singtel? That’s a bargain.)

- First two months of Spotify get a special $1/month rate if you’re already a Singtel customer.

- Say goodbye to pesky local data charges.

- Even if you already have Spotify Premium solo, this plan slim down your monthly spend by a few bucks.

Why It Works

Essentially, it’s the same as buying a group ticket for a concert: you share the fee, plus the free download option keeps your data bank from draining faster than a mosquito in a humid climate.

Bonus Sides

— Shopping & Dining secrets coming soon

— Grocery & Lifestyle Hacks to keep your day-to-day budget in check

Take control, save money, and keep spinning those playlists. Your wallet will thank you, and so will your taste buds.

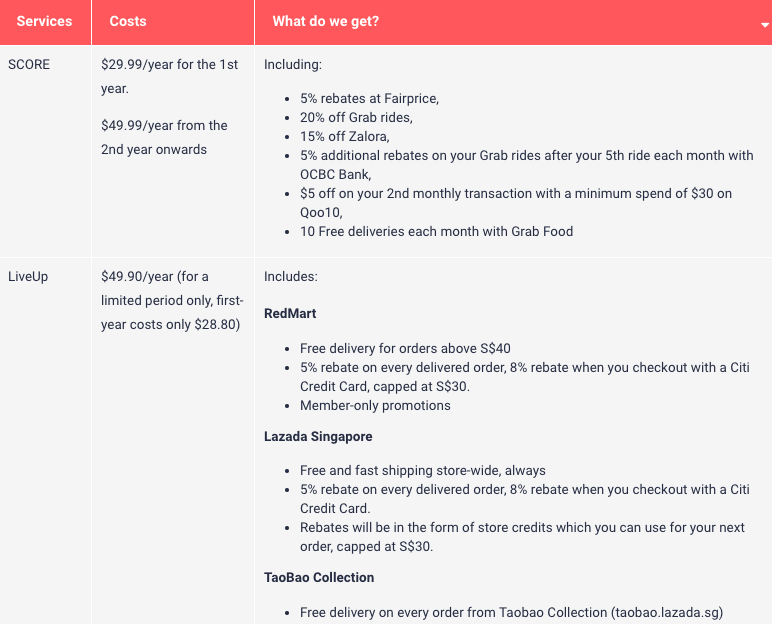

How to Maximize Your Savings with Shopback

Ever wondered how to make your everyday spending work for you? It all boils down to picking the right membership and knowing which bank cards you’ve got in your wallet.

LiveUp – The Citi Card Hero

If your debit or credit card is from Citi, LiveUp is like a secret savings vault. It offers generous rebates on a wide range of purchases.

Amazon Prime – The Baby‑Friendly Deal

Parents, this one’s for you. Amazon Prime delivers more than just movies; it hands you free 2‑hour deliveries on baby essentials—think diapers, wipes, and more. Ideal for those midnight snack runs and sudden diaper emergencies.

SCORE – The OCBC Card Grabbers

Score looks tempting if you’re an OCBC cardholder who loves Grab rides and frequent trips to FairPrice. However, take a closer look at the fine print—some conditions might trip you up when redeeming offers.

Key Takeaway

The smartest choice is the one that lines up with your most-used services and current bank cards. Save smart, shop smarter, and enjoy the perks that suit your lifestyle.

Save Money on Reading: Why Pay for Books When You Can Read for Free?

Unlock unlimited reading without the price tag. Instead of shelling out for books, pick the free version via Overdrive and rent from the National Library Board. Simple, cheap, and you get a whole library at your fingertips.

Amazon’s Kindle Unlimited—Too Late for Singapore?

Amazon has a Kindle Unlimited subscription that offers diverse titles, but it’s not rolled out in Singapore yet, so for now, stick with the free options.

Quick Tips to Keep Your Wallet Happy

- Use Overdrive for free e‑books and audiobooks.

- Check out the National Library Board’s offers on racks.

- Keep an eye on local promotions and free-reading events.

And There’s More—Game On!

Exciting games are also pulling you in, but that’s a whole other adventure.

How to Save on Gaming Without Sacrificing Fun

Free, casual, and budget‑friendly ways to keep your console life colorful.

1⃣ Grab the Freebies

- Many publishers drop free-to-play titles that let you jump right in.

- Check out Steam’s “Free Weekend” events or Xbox’s Free Games of the Week.”

- Mobile spin‑offs: the same game, but on your phone.

2⃣ Bundle Up When You’re a Power Player

If you clock 3–4 hours a week and love to sample new worlds, subscriptions can pay off.

- Xbox Game Pass Ultimate – everything from the library plus cloud play.

- PlayStation Plus – free monthly titles, a digital shop.

- EA Play – early access to huge Euro-centric hits.

Think of It Like a Gym Membership

Just like you only pay for the workout you actually go to, choose a plan that fits your real playtime.

3⃣ Mix and Match

Opt for a community drive where you swap titles with friends.

- Rotate games weekly.

- Share subscriptions through “family plans.”

4⃣ Time‑Saving Tricks

Use pre‑order bundles, season passes, or collector’s editions only when you’re going long haul.

Bottom Line

Stay flexible – pair free games with paid bundles when you crave variety, and keep it tight when you’re only gaming a few hours a week. Your wallet (and your mood) will thank you.

How to Stop Your Wallet From Taking a Vacation

Ever feel like the only thing that keeps your paycheck happy is a monthly subscription fee? Yeah, we get it. Let’s find ways to keep that gold mine working for you instead of one-way street.

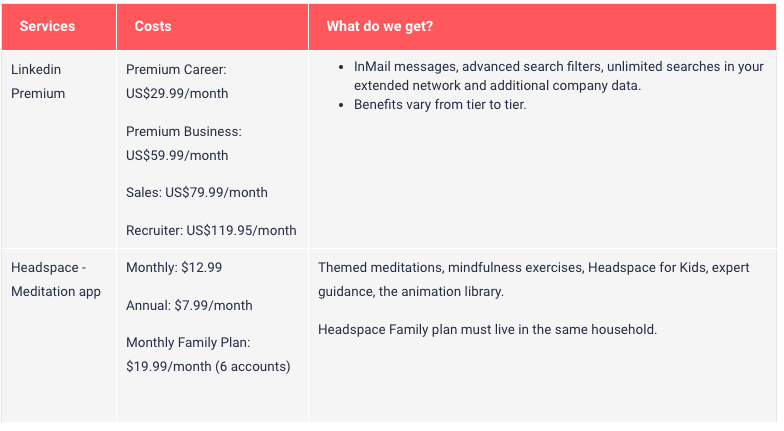

LinkedIn: Your Secret Ticket to Free Professional Boost

LinkedIn is a rockstar networking spot for HR pros, sales gurus, and anyone wanting to pad their résumé. Want the perks without paying? Most of the good stuff is freely available. For a tiny extra cost, companies can even cover the fee if you use it for work. So feel free to level up—no wallet‑sizzling needed.

Mindfulness on a Budget: Where to Find Zen Without Breaking the Bank

Headspace is the pep‑top app for meditation, but if you’re shy about a monthly fee, don’t fret. There are heaps of free alternatives—think YouTube channels, other meditation apps, or even a simple walk away from your phone. Find your calm, and let your bank account stay calm too.

Subscriptions: Pandora or a 99¢ Conundrum?

Yes, subscriptions can be a lifesaver—coffee delivered, books on demand, premium video for your dinner dates—but they can also sneak past you like a stealthy burglar. When payments auto‑repeat, you risk paying for things that no longer feel “worth it.” The trick: check in often.

- We Love It, We Pay For It: Like that gourmet coffee subscription. Great beans? Sure. Too many cups? Absolute waste.

- Disposable Mistakes: One month you binge a new series; next you forget it’s still queued for pay‑per‑seasons.

The $50-a-Month Riddle

I went through a cleanup exercise—books, bills, apps, domains, heck, even that podcast membership you never listen to. The joy? I discovered 50 bucks I’d unwittingly paid each month, just to say “I’m a fancy‑ish guy.” That’s a whopping $600 a year on idle subscriptions. Outcome? Hit cancel. Rebound = 12 months of extra cash at your disposal.

Take the Wheel: Your Subscription Checklist

Lords of the subscription realm, here’s your roadmap:

- Periodically audit: Once a month, glance at all recurring payments.

- Track due dates: Calendar alerts—so you never miss a bill or forget a try‑out end.

- Do the math: If the cost outweighs the benefit, yank the cord.

- Choose wisely: Prefer PayPal—easier to cancel vs. credit card. Save the memory card for your credit cards.

General rule: Don’t let a subscription become a hidden fee that sticks to you longer than the product it supports. If you’re in a free trial, set a reminder to cancel before it turns into a charge. You become the financial superhero of your own wallet.

Real Talk: We All Want More Cashback, Not More Subscriptions

If food‑centric services and subscriptions are not your thing, try ShopBack GO—no sneaky charges, no hidden strings. All you get: a sweet cashback that props up your wallet with every bite.

Shining a spotlight on subscription spend doesn’t just lead to a healthier budget—it also keeps you in the loop for the best creative ways to save more. Got cool hacks? Throw them into the comments—let’s keep the budget magic buzzing together.